Top Lists

Top 10 Loan apps in Nigeria to get a Quick Loan without Collateral (2023)

Loan apps have become an increasingly important source of financial support in Nigeria, especially in recent years. Many people in Nigeria rely on these apps as a way to access loans quickly and easily, without having to go through traditional banks or other financial institutions. Loan apps offer a convenient and flexible way to borrow money, allowing users to apply for loans from their smartphones and receive funds almost instantly.

This can be especially helpful for individuals who may not have a good credit score or collateral to secure a loan through traditional channels. Additionally, loan apps often have less strict eligibility requirements and lower interest rates compared to traditional loans, making them a more affordable option for many borrowers. Overall, loan apps have played a significant role in increasing access to financial resources and helping people in Nigeria manage their finances more effectively.

How do loan apps work?

Loan apps work in this way: You download the app from your app store. Install it on your phone. open the app, register with your correct details, and any document needed. Your credit score will be calculated and you get a loan offer. Once you accept the loan, it will be credited to your account. You will have to pay back your loan before or by the due date.

The majority of the loan apps in Nigeria do not require collateral or guarantors. So you do not need to worry about that.

Loan apps are very useful for emergencies. When you need an emergency loan, all you need is to open the loan app and apply for a loan. Most loan apps work 24/7.

You may need money for house rent, school fees, travel, or business. Loan apps will always be resourceful in times like that. It is very advisable to have one or two installed on your phone. Because you never know when you may need it. There are loan apps available for Android, iOS, Blackberry, and Windows phones.

Benefits of Loan Apps In Nigeria

1. Easy and Fast Process

The advantage of borrowing funds online is that the process is easy. You do not need to come to the bank and the bank also does not need to come to your place.

The entire registration process, verification, and disbursement of loan funds are carried out remotely and online. The process is also fast, in just a few days you will receive the loan funds. The whole process can be done only with a mobile device and an internet connection.

2. Easy Requirements

Another advantage of using an online loan is that the requirements are easier. If you borrow from a bank, of course you have to meet various requirements that are quite complete.

If you cannot fulfill the specified requirements, then the loan application process will be hampered. However, you will not encounter this when applying for a loan online. Requirements and required documents are looser and less stringent.

In general, the requirements to apply for a loan include an ID card and are of legal age. Therefore, anyone can apply for a loan from business people to employees.

3. Affordable Loan Interest Rate Options

When deciding to make a loan, interest rates are an important thing for the borrower to pay attention to. Now, online lenders offer loans with friendly and affordable interest rates.

So, in addition to getting convenience in applying for and getting a loan, you are also not burdened with loan interest.

In this case, you as a consumer must be observant in choosing online loan services. Choose an online loan provider that offers low interest rates with various loan tenors. A variety of tenor options will help you adjust the loan term according to your needs.

4. Safe

Worried about the security of using online loan services? Or are you worried because you often hear bad news regarding this online loan?

Take it easy, if you choose the right service provider, you will get comfort and a sense of security when using online loan services. One way is to choose an online loan that has been registered with the Financial Services Authority and other important institutions. If you have obtained official supervision and permission, then the online loan is safe to use.

5. It is very Fast

For those of you who need fast and urgent funds, online loans are able to overcome these problems. This is because the process is indeed easy and instant to carry out the registration process to the disbursement of loan funds.

In addition, the verification process carried out by the service provider is also fast. Without a long time, you can get loan funds in a fast time to meet your needs.

Top 10 loan apps in Nigeria to get a quick loan without collateral

Here are the top 10 loan apps in Nigeria to get a quick loan without collateral

1. OKash

Top 10 Loan apps in Nigeria to get a quick loan without collateral (2023) – OkashOKash is a micro-lending platform presented by Blue Ridge Microfinance Bank Limited. It gives its registered users access to quick collateral-free loans as long as they meet the requirements. You can get loans from 3,000 Naira to 500,000 Naira.

OKash provides loans 24/7, and the whole process is entirely online. Users can download OKash from Google Play and set up their loan account in seconds, select their preferred bank account, link their active bank card for repayment, fill out a set of questions, and get a decision on their loan application in minutes with paperless.

2.RenMoney

Top 10 Loan apps in Nigeria to get a quick loan without collateral (2023) – RenmoneyRenmoney is a lending company that operates as a microfinance bank in Nigeria. The company prides itself as the most convenient online lending company for businesses and individuals in Nigeria. It provides convenient loans to meet needs like growing your small business, renovating your home, buying a new car, paying rent, school fees, medical bills, etc. You can get up to 6 million Naira for up to 24 months.

Download the RenMoney App to get instant access to credit.

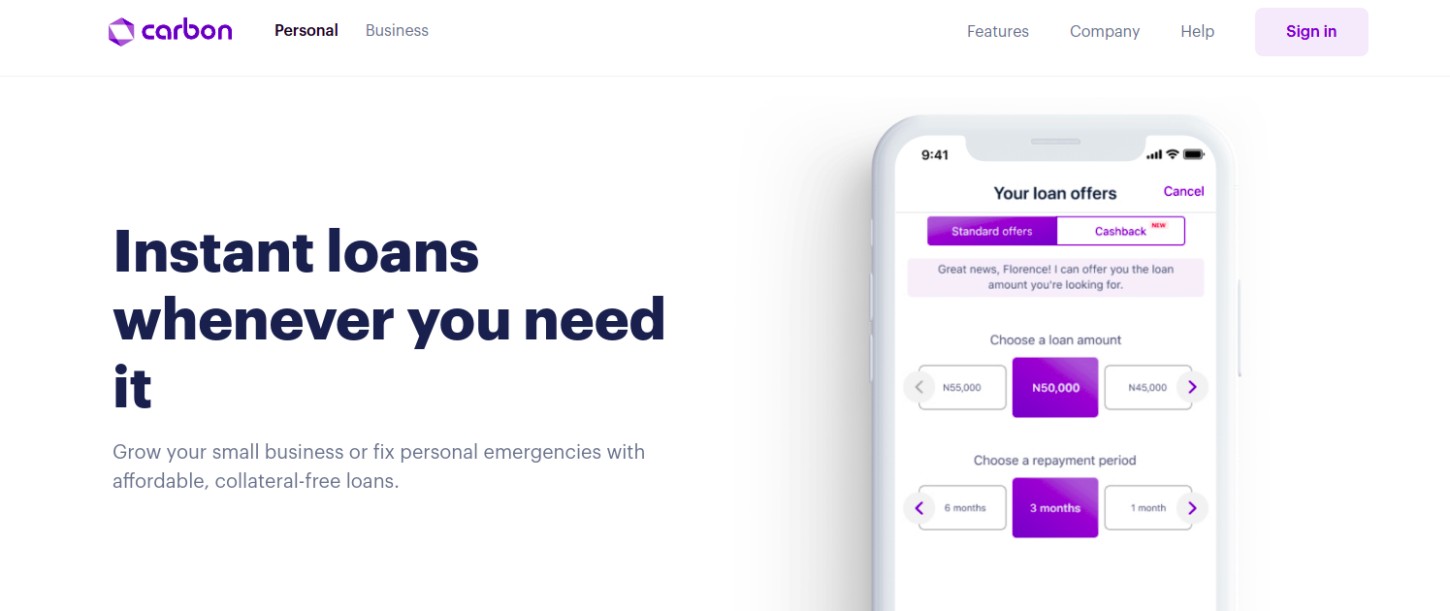

3. Carbon (Pay later)

Top 10 Loan apps in Nigeria to get a quick loan without collateral (2023) – Carbon

Carbon formerly known as Paylater is one of the top mobile phone loan apps available in Nigeria. It is easy to use and you can get a loan quickly without much delay. You can get a loan of up to ₦1 million from this app

It does not require a collateral or guarantor to get a loan from Carbon. All you have to do is download the app into your phone. Register with your accurate details and then apply for a loan. The app is fast, you may get a loan offer in a few minutes.

They charge a flexible interest rate from 5% to 15% depending on the amount and repayment period.

You can pay back your loan easily from the app using your ATM.

4. Kuda

Top 10 Loan apps in Nigeria to get a quick loan without collateral (2023) – Kuda

Kuda, the bank of the free as they are popularly called, offers short term loans in the form of overdrafts to regular customers. Their overdrafts require no paperwork and come with a 0.3% daily interest rate. The overdrafts typically last 90 days but repayments are expected to begin 30 days after disbursement.

5. FairMoney

Top 10 Loan apps in Nigeria to get a quick loan without collateral (2023) – Fairmoney

With the FairMoney app, you can get a loan of up to ₦150, 000 with just a few clicks. It is fast, easy, and secure. This app is one of the most downloaded loans app in Google Playstore.

All you have to do is download the app, and install it on your phone. Then you can proceed to sign up with your Facebook account or with your phone number. Then you answer a couple of questions. After that, you will be sure to get a loan offer.

Once you get an offer, accept it and the money will be credited into your bank account. It is that easy.

They have a flexible interest rate. You can pay back your loan installmentally for up to 3 months.

6. Palmcredit

Top 10 Loan apps in Nigeria to get a quick loan without collateral (2023) – Palm Credit

You can get a loan by using the Palmcredit software, which can be downloaded from the internet. Make an application for a quick loan that has a reasonable interest rate and a number of different repayment options to choose from.

The parent company of Palmcredit is called Newedge Finance Limited (RC1585793), and it is fully licensed by the Central Bank of Nigeria (CBN) to operate as a finance company in Nigeria.

7. KiaKia

KiaKia is a licensed non-banking financial technology firm that was established in 2016. It trades under the name KiaKia, which is the trading name of KiaKia Bits Ltd (RC:799552).

Kiakia is a popular loan app in Nigeria that offers quick and easy access to financial support for individuals and small businesses. With Kiakia, users can apply for loans directly from their smartphone and receive funds almost instantly, without having to go through a traditional bank or financial institution. Kiakia offers a range of loan options, including personal loans, business loans, and emergency loans, making it a versatile resource for a variety of financial needs.

The app also has a user-friendly interface and a simple application process, making it easy for users to access the financial support they need. Overall, Kiakia is a reliable and convenient option for people in Nigeria looking for quick and easy access to loans.

8. Branch

Top 10 Loan apps in Nigeria to get a quick loan without collateral (2023) – Branch

Branch is a simple yet powerful mobile loan app in Nigeria and Kenya. Getting quick and instant loans on Branch App is so fast and easy. It will help you sort out your financial issues in real-time.

Branch offers loans from ₦1,500 to ₦150,000. Loan terms range from 4 – 64 weeks. Interest ranges from 14% to 28%, with an equivalent monthly interest of 1% to 21%, depending on the selected loan option.

9. Lendigo

Lendigo is an SME finance provider that offers Nigerian SMEs easy, fast, and flexible access to working capital according to their business requirements and suited to their finance needs. With Lendigo, you can access business loans from 100,000 Naira up to 1,000,000 Naira.

By installing their Loan App on your smartphone, you can easily apply for a loan at a very low-interest rate and get it credited straight into your bank account, even if your business is not registered.

10. Aella credit

Top 10 Loan apps in Nigeria to get a quick loan without collateral (2023) – Aella Credit

Aella credit is a mobile loan app that gives loans up to ₦100, 000 without collateral and paperwork. It is highly secure and quite popular.

To get a loan, simply download and install the app. Then you register. Fill the application form. And you can receive a loan without much delay.

The loan tenure is 30 to 60 days. And the interest rate varies from 4% – 29%.

Conclusion.

While most of these platforms claim to offer quick loans without any collateral, it is advisable to carefully study their Terms & Conditions (T&C) before throwing in an application.

Another factor to consider is the interest rate and payback period. As a business, you will not want to go in for loans with a very short payback period unless you are sure you will earn back the money in no time.

READ MORE:

- Best Loan Apps in Nigeria To Get Up 500K Without Collateral (Top 7)

- Loan Apps With The Lowest Interest Rates In Nigeria (Top 10)

SOURCES: