Business News

Top 10 Best Investment Companies in The World

In a sector that experiences constant annual growth, the top 10 investment Companies in the world are rising at a phenomenal rate. Here is…

Top 10 Best Investment Companies in The World: In a sector that experiences constant annual growth, the top 10 investment Companies in the world are rising at a phenomenal rate. What does asset management entail? Investment management is the professional management of various assets, such as real estate and other assets, to achieve specific investment objectives for the benefit of the investors. Typically, this involves managing shares, bonds, and other securities.

How much is the business of investment management worth? By the end of 2022, there will be $102 trillion in investable assets, up from roughly $64 trillion today, representing a compound annual growth rate (CAGR) of nearly 6%. The three best investment firms are BlackRock, The Vanguard Group, and Charles Schwab Corporation.

An investing company is what? In the simplest words, an investing firm “pools” investor funds, invests them in the proper security instruments and increases investor funds. Asset managers exist to remove the emotions from investing despite the rise of passive investment. The top asset managers are there to raise these figures so that people and businesses may concentrate on steady yields rather than the tiresome process of buying and selling. The average investor’s return is 2.8%.

READ MORE: Top 10 Investment Banks in The World and Their Assets

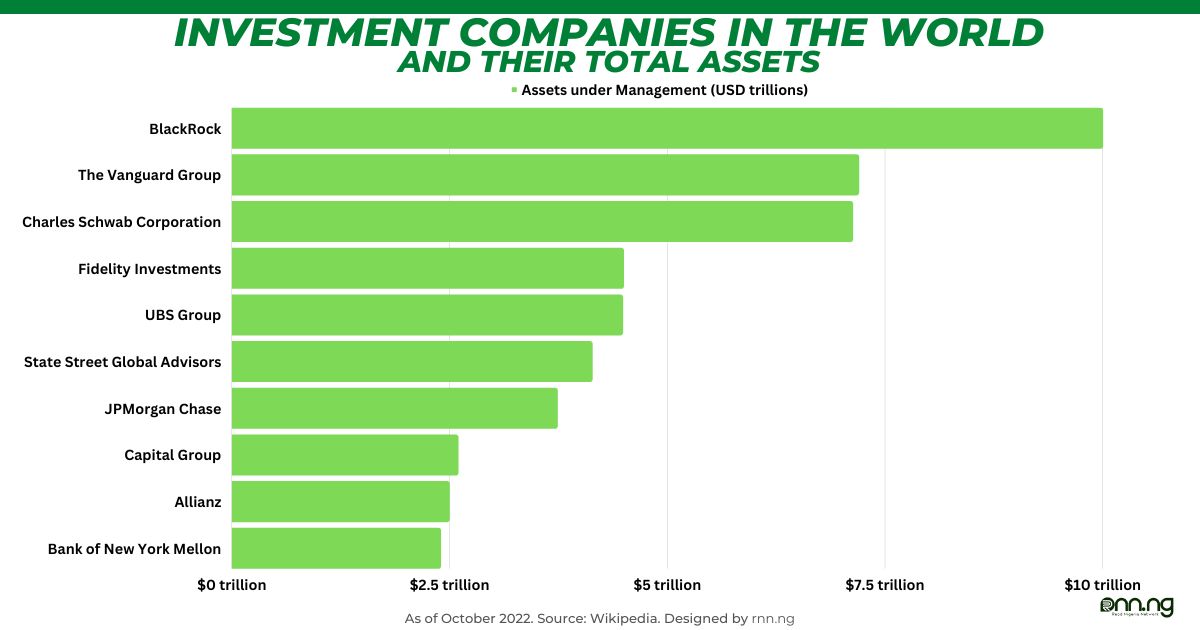

Below is the line Graphical representation of the Top 10 Best Investment Companies in The World

Top 10 largest Investment Companies in The World

Top 10 Best Investment Companies in The World

1. BlackRock-$10 trillion

Founded: 1988

Headquarters: New York City, New York, USA

AUM: USD 7.43 trillion

Number of Employees: 14,900

What is the top investment company? BlackRock is the largest investment company in the world by assets under management, with assets under management totaling $10 trillion. BlackRock is a New York City-based American global investment management company that was established in 1988.

It currently has 70 locations in 30 countries serving clients from 100 different nations. With 14,900 employees, BlackRock is currently the largest shadow bank in the world. A shadow bank is a group of non-bank financial intermediaries that offer services akin to those of typical commercial banks but are exempt from standard banking laws.

The business is renowned for having pioneered the development of exchange-traded funds (ETFs). BlackRock provides a range of mutual funds and investment portfolios that invest in stocks, money market instruments, and fixed securities. On the RNN list of the top 10 investment firms by assets handled, BlackRock comes in at number one.

BlackRock Investment Management Products

Mutual funds

Investments focused on objectives related to retirement income and college savings

Exchange-traded funds (ETFs)

2. The Vanguard Group-$7.2 trillion

Best Investment Companies in The World

Founded: 1975

Headquarters: Malvern, Pennsylvania, USA

AUM: $7.2 trillion

Number of Employees: 16,600

On the RNN list of the top 10 investment companies in the world by assets handled, Vanguard comes in at number three. With $7.2 trillion in assets under management, Vanguard is an American registered investment manager with headquarters in Malvern, Pennsylvania. In terms of ETFs, Vanguard is the second-largest mutual fund business in the world, behind only Charles Schwab Corporation. Since its founding in 1975, Vanguard has provided brokerage services, variable and fixed annuities, services for educational accounts, financial planning, asset management, and trust administration.

Vanguard Investment Management Products?

- Mutual funds

- Exchange-traded funds

- Broker

- Asset management

- Sub-advisory services

3. Charles Schwab Corporation-$7.13 trillion

Founded: 1971

Headquarters: San Francisco, California, USA

AUM: USD 3.3 trillion

Number of Employees: 19,500

Charles Schwab Corporation, an American global financial services company headquartered in San Francisco, California, is ranked second on RNN’s list of the top 10 best largest investment companies in the world. The company’s computerized trading platforms, investment management education, and reduced brokerage services are what it is most known for. The company’s reduced or free trade commissions are its main selling point, attracting investors from all over the world to its trading platform.

The second-largest asset manager in the world, Charles Schwab Corporation, has more than 345 locations across the globe. Based on its current AUM of $7.13 trillion and its USD 10.13 billion in income from the previous year, the company is among the top investment firms on this list.

4. Fidelity Investments-$4.5 trillion

Best Investment Companies in The World

Founded: 1946

Headquarters: Boston, Massachusetts, USA

Revenue: USD 18.2 billion

AUM: $4.5 trillion

Number of Employees: 50,000

With $4.5 trillion in assets under management, Fidelity Investment rank as the fourth-largest asset manager in the world, making it one of the top firms in the financial investment sector. Over 50,000 people work for Fidelity Investments, an American international financial services company with headquarters in Boston, Massachusetts.

As of the third quarter of 2022, Fidelity had more than 30 million clients and served as both a discount broker and an asset manager. It provides an online marketplace for buying and selling securities by individual investors.

Additionally, Fidelity handles whole portfolios for clients. It gained notoriety in the summer of 2018 when it started promoting mutual funds with no expense ratio and no minimum investment amount.

READ MORE: Top 10 investment companies in Nigeria

5. UBS Group-$4.49 trillion

Founded: 1862

Headquarters: Zürich, Switzerland

Corporation Revenue: USD 30.21 billion

AUM: $4.49 trillion

With $4.49 trillion in assets under management, UBS Group ranks fifth among the world’s top 10 best investment companies. UBS Group is a global investment bank and provider of financial services. The corporation is renowned for preserving its status as the largest Swiss banking institution in the globe in all significant financial cities.

With a research facility in London to strengthen its cybersecurity and encrypt client operations, UBS has been expanding its offerings and embracing blockchain technology. Due to its rigorous bank-client confidentiality policies and culture of banking secrecy, UBS is a successful asset management company.

6. State Street Global Advisors-$4.14 trillion

Best Investment Companies in The World

Founded: 1978

Headquarters: Boston, Massachusetts, USA

AUM: $4.14 trillion

Number of Employees: 2,800+

The fifth-largest asset manager in the world, State Street Global Advisors, is ranked sixth on this list of the best largest investment companies by assets managed. With $4.14 trillion in assets under management in 2022, State Street Global Advisors, the investment management arm of State Street Corporation, ranks fifth among all asset managers globally. State Street Global Advisors offers investment vehicles in the USA, Europe, Asia, and Australia from its 25 offices around the world.

State Street Global Advisors Investment Management Products

- Asset management

- Mutual fund

- Exchange-traded fund

- Sub-Advisory services

7. JPMorgan Chase USD-$3.74 trillion

Best Investment Companies in The World.

Founded: 2000

Headquarters: New York City, New York, USA

Revenue: USD 105.4 billion

AUM: USD $3.74 trillion

Number of Employees: 256,981

The seventh-ranked investment company globally by assets under management on the RNN list is the American multinational investment banking firm, JPMorgan Chase. The corporation, which has its headquarters in New York City and was first established in 1799 as the Bank of the Manhattan Company, operates the third-largest hedge fund in the world.

JPMorgan Chase is in charge of managing $3.74 trillion worth of assets. Along with Bank of America, Citigroup, and Wells Fargo, JPMorgan Chase is one of the major four banks in the United States. By market capitalization, JPM is also the most valuable bank in the entire globe.

8. Capital Group-$2.6 trillion

Founded: 1931

Headquarters: Los Angeles, California, USA

AUM: USD 1.9 trillion

Number of Employees: 7,500

Capital Group is among the top 10 largest investment companies in the world according to RNN. With $2.6 trillion in assets under management, Capital Group, an American provider of financial services, is ranked eighth on this list of the biggest investment management firms.

9. Allianz$-2.5 trillion

Top 10 Insurance Companies in The World

Founded: 1890

Headquarters: Munich, Germany

Revenue: USD 143.9 billion

AUM: $2.5 trillion

Number of Employees: 147,268

With $2.5 trillion in assets under management, Allianz is the first German company on this list of the biggest best investment asset management companies. A worldwide financial services firm with its headquarters in Munich, Germany, is called Allianz. According to Forbes, the firm is the biggest insurance provider in the world. Asset management and insurance are its main lines of business.

Allianz conducts business throughout a number of nations, including Belgium, Germany, Australia, Canada, the United States, and more. Insurance and asset management are Allianz’s major areas of expertise.

10. Bank of New York Mellon-$2.4 trillion

Best Investment Companies in The World

Founded: 2007

Headquarters: Manhattan, New York, USA

AUM: $2.4 trillion

Number of Employees: 51,300

With $2.4 trillion in assets under management, The Bank of New York Mellon is among the leading investment management companies worldwide. An American holding company for the global banking and financial services with its main office in New York City is called The Bank of New York Mellon. One of the oldest financial institutions in the world was its predecessor. BNY Mellon administers assets for private investors as well as investments across 35 nations.

Bank of New York Mellon Investment Management Products?

- Corporate banking

- Investment banking

- Global wealth management

- Financial analysis

- Private Equity

READ MORE: Top 10 Best Long-Term Investments For Building Wealth

Summary

Here is the summary list of the Top 10 Best Investment Companies in The World

- BlackRock-$10 trillion

- The Vanguard Group-$7.2 trillion

- Charles Schwab Corporation-$7.13 trillion

- Fidelity Investments-$4.5 trillion

- UBS Group-$4.49 trillion

- State Street Global Advisors-$4.14 trillion

- JPMorgan Chase-$3.74 trillion

- Capital Group-$2.6 trillion

- Allianz-$2.5 trillion

- Bank of New York Mellon-$2.4 trillion