Top Lists

Top 10 Best Long Term Investments For Building Wealth

Top 10 Best Long-Term Investments For Building Wealth: Investing is one of the best methods to safeguard your financial future, and one of…

Top 10 Best Long-Term Investments For Building Wealth: Investing is one of the best methods to safeguard your financial future, and one of the best ways to invest is over an extended period of time.

Over the past few years, it would have been tempting to stray from a long-term strategy and go after rapid gains. But given the market’s present high valuations, it’s more crucial than ever to concentrate on long-term investing while adhering to your investment strategies.

Many investors look to the stock market as a means of long-term wealth accumulation. You have other investment options besides this one, though.

To achieve your financial objectives, you can choose from a variety of investing options. We’ll go over the finest long-term investment options in this piece. Choosing the ones that make the most sense for your investing strategy and risk tolerance is the key for you.

You must be aware of your precise time horizon before I can discuss the several long-term investing options.

What is Investment Time Horizon?

The investing time horizon of a person is the length of time they anticipate keeping investment to attain a specific objective. Investments are often classified into two main categories: stocks, which are riskier, and bonds, which are less risky. The longer an investor’s time horizon, the more aggressive or risky a portfolio they can create.

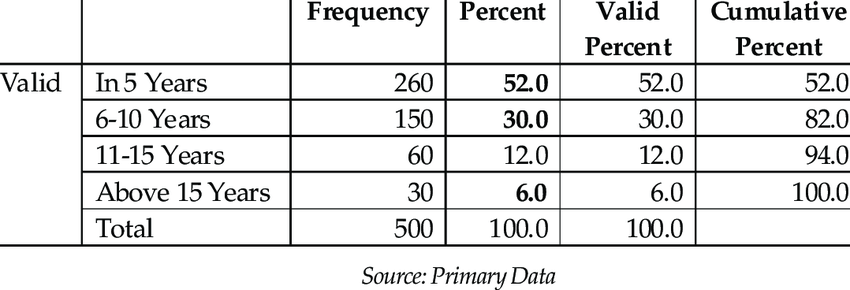

Here is a small table in the image below for your use:

Investment-Time-Horizon-of-Investors

The illustration shows that short-term investments are preferable if your time horizon is 5 years or less.

Long-term investments are where you should put your money if, on the other hand, your time horizon is greater than five years.

READ MORE: 6 Profitable Real Estate Investment Opportunities To Put Your Money To Work

The explanation is straightforward.

The chance of losing money with a long-term investment over a short period of time is simply too great. Your investments could lose value as a result of the economy entering a recession, the stock market experiencing a correction or another geopolitical event.

As a result, you must ensure that your investment choices are in line with your financial objectives. Let’s discuss the numerous long-term investment options you can use now.

Top 10 Best Long-Term Investments For Building Wealth

- Stocks

- Mutual Funds

- Exchange Traded Funds

- Municipal Bonds

- Treasury Bonds

- Corporate Bonds

- Inflation-Protected Securities (TIPS)

- Savings Bonds

- Real Estate

- Annuities

1. Stocks

Top 10 Best Long-Term Investments For Building Wealth

A share of stock gives you ownership of a portion of the corporation because stocks are considered equities.

The typical investor can anticipate a long-term rate of return on their stock investments of about 7-8% annually.

Developing long-term wealth is made easy by doing this. However, the issue most investors have with stocks is that they let their feelings guide their decisions and end up buying and selling quite a bit.

As I already said, equities are for the long term, therefore this is not ideal. Frequent trading effectively converts them into short-term investments. When you do this, your chances of losing money or earning a return that is lower than you should are considerably increased.

You must be aware of the various stock asset classes if you want to invest in stocks. Doing your homework can help you choose investments that make sense for you because some are riskier than others. Stocks are divided into large-cap stocks and small-cap stocks according to market capitalization.

Mid-cap stocks are another option; they lie in between large and small. Stocks are then further divided up from there. Here is a quick rundown of some of your investment alternatives.

- Stock funds

- Dividend Stocks

- Value Stocks.

Stock funds

Growth stocks are businesses with expanding revenue, and as a result, their stock values are rising more quickly.

Overview: Growth stocks are the Ferraris of the stock market. Excellent growth and high investment returns are what they claim. Tech businesses are frequently growth stocks, although this is not a requirement.

They rarely pay out a dividend, at least not until their growth slows down, as they typically reinvest all of their profits back into the company.

Who are they good for?: If you plan to purchase individual growth stocks, you should properly research the business, which can take a lot of time.

You’ll also need to have a high-risk tolerance or make a commitment to owning the stocks for at least three to five years due to the volatility of growth stocks.

Risks: Growth stocks are prone to risk due to the fact that investors frequently overpay for the stock in comparison to the company’s profitability.

Therefore, these stocks may lose a significant amount of value very fast in the event of a bear market or recession. It appears as though their unexpected popularity vanishes in a moment. However, over time, growth stocks have been among the greatest performers.

Rewards: If you can identify the appropriate company, the reward might be endless. The largest companies in the world, such as Alphabet and Amazon, have all experienced rapid development.

Where to buy them: Any online broker that provides stock trading is a good place to buy them.

Dividend Stocks

These stocks provide owners with dividends. Better use of revenue, in the opinion of corporations that pay dividends, is to distribute money to shareholders rather than reinvest it back into the company.

Overview

Dividend stocks can generate respectable returns but are less likely to soar higher as quickly as growth equities, which are the sports cars of the stock market.

A stock that pays a dividend, or a regular cash distribution, is just one that does that. There are many equities that pay dividends, but they tend to belong to more established, older businesses that don’t need as much cash.

Older investors like dividend stocks because they provide a consistent income and the finest firms raise that dividend over time, allowing you to earn more than you would with a bond’s set distribution. One well-liked type of dividend stock is REITs.

Who are they suitable for? Dividend stocks are best for long-term buy-and-hold investors, especially those who want or require a cash distribution and desire less volatility than the market average.

Risks: Despite the fact that dividend stocks are typically less volatile than growth stocks, don’t assume they won’t experience substantial ups and downs, particularly if the stock market experiences a difficult period.

Nevertheless, a dividend-paying corporation is typically safer than a growth company because it is more established and mature.

However, if a dividend-paying firm doesn’t make enough money to cover its dividend, it will reduce the payout, which could cause its price to fall.

Rewards: A dividend stock’s payout is one of its main selling points, and some of the best companies offer payouts of up to 4% yearly. But more importantly, they have the ability to increase payouts by 8 or 10 percent annually over extended periods of time, meaning you’ll get paid more normally every year.

Although there is a chance for significant gains, they won’t typically be as high as with growth companies. Additionally, there are several dividend stock funds accessible if you wish to invest in them in order to hold a diverse range of stocks.

Overall, stocks are among the Top 10 Best Long-Term Investments For Building Wealth which are attractive to most investors.

Where to buy them: Any online broker that provides stock trading is a good place to buy them.

Value Stocks

The opposite of growth stocks is value stocks. They have established businesses with modest growth whose stock price doesn’t increase as quickly.

Overview: Many stocks have stretched valuations during periods of significant market gains. When that occurs, a lot of investors look to value stocks as a means to be more defensive while still having a chance to make good profits.

Value stocks are ones that are less expensive based on valuation criteria like a price-earnings ratio, which calculates how much investors are paying for every dollar of earnings.

Value stocks may be a desirable choice in 2022 because they often perform well when interest rates are rising. Additionally, the Federal Reserve has been swiftly hiking interest rates this year.

Risks: Value stocks frequently have less potential for loss, therefore they typically decline less when the market does. They can still rise if the market does, too.

Rewards: If the market once again supports value stocks, their values may grow more quickly than those of other non-value equities. Value stocks are so appealing because they offer above-average returns while posing a lower risk.

There are several value stocks that also pay dividends, so you can also receive some additional returns there.

Where to buy them: Any online broker that provides stock trading is a good place to buy them.

2. Mutual Funds

Top 10 Best Long-Term Investments For Building Wealth

Mutual funds are collections of securities, such as stocks, bonds, or both.

As a result, you have the option of investing in stock funds, bond funds, or balanced funds, which combine stock funds and bond funds in varying proportions. There are two reasons why you should invest in ETFs as opposed to individual stocks.

Owning a mutual fund is, first and foremost, a considerably more economical choice for buyers.

By investing in a mutual fund, you can purchase thousands of firms for only $100, as opposed to just a few pieces of stock in a single company.

With mutual funds, you are instantaneously diversified. As an investor, you can reduce some of your risks by owning many businesses.

Due to the advantages they offer, mutual funds are a highly well-liked investing option. With very little capital, you can make investments while reducing some of the risk associated with making a lot of investments in a single business.

Of course, mutual funds have drawbacks as well, but for the ordinary investor, mutual funds are where you should put the majority of your money.

3. Exchange Traded Funds

Top 10 Best Long-Term Investments For Building Wealth

Mutual funds and exchange-traded funds, or ETFs, are quite similar.

The primary distinction is that you can trade ETFs at any time of day but, regardless of when you purchase or sell during the day, you always receive the mutual fund’s closing price with mutual funds. The tax efficiency at which they function is another advantage.

You often pay the lowest investment costs in the market, and they don’t often distribute capital gains to their clients. Last but not least, the majority of ETFs are index funds, which means they follow underlying indices passively. Because your investing fees are lower than the industry average, more of your money can compound over time.

4. Municipal Bonds

Top 10 Best Long-Term Investments For Building Wealth

Municipalities need to complete a variety of tasks. They frequently lack the funding required for these undertakings.

As a result, they will issue bonds to raise the necessary funds and in exchange, will pay the bond’s ownership interest. Municipal bonds often have terms that range from 10 to 30 years long.

They, therefore, make wise long-term investments. Due to the length of their duration, they are not the best investments for the short term.

Let’s imagine, for illustration, that you possess a bond with a 4% interest rate. Five years later, fresh bonds with an 8% interest rate are released. Obviously, you want to earn 8% instead of 4%, but your bond is only able to pay you 4%.

The bond can only be kept or sold as your only option. Due to low demand, you will receive less money for the bond if you decide to sell it. Who, after all, would pay full price for a bond earning 4% when they can get a bond paying 8%? The fact that your income is often tax-free in the state in which you live is another advantage of municipal bonds.

5. Treasury Bonds

The United States government issues bonds known as Treasury Bonds.

The likelihood that the United States government will stop paying interest on its bonds is low, thus you won’t make any money from holding them.

U.S. Treasury bonds have a duration that can last up to 30 years, similar to the municipal bonds mentioned above. As a result, they are the best choice for long-term investments.

Of course, I cannot ignore the tax treatment of these bonds, which is a significant advantage. You do not pay federal income tax on the interest you earn because these bonds were issued by the federal government.

The interest can be taxed on your state tax return depending on which state you reside in.

6. Corporate Bonds

Corporate bonds are debt instruments used by businesses to finance the purchase of additional machinery, inventories, and other items.

They have a higher interest rate than government bonds since they are riskier.

7. Inflation-Protected Securities (TIPS)

A TIP, or inflation-protected security, is a type of bond.

However, you also receive an additional interest adjustment depending on inflation in addition to paying a fixed rate of interest.

Based on the rate of inflation, an adjustment for inflation is performed every six months.

With the help of this function, you may lessen the interest risk associated with bond ownership, which reduces the chance that the bond’s value would decline dramatically.

Naturally, given that these are fixed-income assets, don’t anticipate general high-interest rates.

8. Savings Bonds

A long-term investment is a savings bond. Traditionally, grandparents would give these to their grandkids at Christmas. That isn’t very frequent these days, though.

Savings bonds have a 30-year duration, although you are allowed to redeem them earlier. However, depending on when you redeem them, you might be required to pay a 3-month interest penalty.

9. Real Estate

Top 10 Best Long-Term Investments For Building Wealth

For a number of reasons, real estate investments are a wise choice you can make from these Top 10 Best Long-Term Investments For Building Wealth.

First off, the housing market has a history of being very steady. This indicates that you will often experience a return on your investment that is favorable.

Your real estate investment trusts may also become a source of passive income depending on how you invest in real estate. Of course, real estate has significant disadvantages as well. Cost is by far the biggest.

You will want a large sum of money just for the down payment if you want to purchase a home or apartment building to rent out. Real estate crowdfunding is one novel technique to get around this. Here, you pool your funds with those of other investors to purchase a property.

Afterward, you receive a monthly income from the rent and the long-term capital gain when you sell in proportion to your ownership percentage.

10. Annuities

An annuity is a contract that you have with an insurance provider that calls for regular payments to be made by the insurer to you, either now or in the future. Either a single payment or a series of payments is required to purchase an annuity. In a similar vein, you may receive your payoff in a single lump sum or over the course of several payments.

Why do individuals invest in annuities?

Typically, people purchase annuities to assist them to manage their retirement income. Three things are offered by annuities:

Payments are made on a regular basis for a set period of time. You, your spouse, or another person may be subject to this for the rest of their lives.

Benefits of death. The person you designate as your beneficiary will get a specified payment if you pass away before you begin collecting payments.

Tax-deferred expansion Until you take money out of your annuity, you do not have to pay taxes on the income and investment gains.

What different types of annuities exist?

Fixed, variable, and indexed annuities are the three fundamental types. Here’s how they function:

Fixed annuity: The insurance provider guarantees you a set quantity of regular payments as well as a set interest rate. State insurance commissioners oversee fixed annuities. To learn more about the advantages and disadvantages of fixed annuities and to make sure your insurance broker is authorized to offer insurance in your state, please contact the insurance commission of your state.

Variable annuity: The insurance provider gives you the opportunity to allocate your annuity payments to a variety of investments, typically mutual funds. Your payout will vary based on your investment amount, investment yield, and outgoing costs. Variable annuities are governed by the SEC.

Indexed annuities: This annuity has elements of both securities and insurance products. The insurance provider gives you credit for a return that is calculated using an index of the stock market, such as the Standard & Poor’s 500 Index. State insurance commissioners oversee index annuities.

Summary

Here is the summary list of the Top 10 Best Long-Term Investments For Building Wealth You Should Know.

- Stocks

- Mutual Funds

- Exchange Traded Funds

- Municipal Bonds

- Treasury Bonds

- Corporate Bonds

- Inflation-Protected Securities (TIPS)

- Savings Bonds

- Real Estate

- Annuities