Business News

List of Assets That Will Be Sold by FG to Fund The 2023 Budget Deficit

list of assets that will be sold by FG: The Federal Government is now compiling a list of assets that will either be sold or given as a…

list of assets that will be sold by FG: The Federal Government is now compiling a list of assets that will either be sold or given as a concession, therefore there are strong indicators that this list will be used to finance Nigeria’s N10.7 trillion budget deficit in 2023. According to Mrs. Zainab Ahmed, Minister of Finance, Budget, and National Planning, the Federal Government is reportedly considering efforts to sell some of its properties through equity investments while generating income from toll roads. Nearly 60 businesses and agencies are linked to the assets, which have a total worth of over N30 trillion.

She said that the Ministry of Finance Incorporated (MOFI) has been revitalized with a board of its own to make it more responsive to its mandate in order to successfully carry out this plan. According to Ahmed, the administration is taking on the revenue problem head-on in an effort to cut the budget deficit and its overall debt load drastically.

She claimed that the Nigerian National Petroleum Company Limited will list on the stock market in the coming year, and it will generate considerable revenue for the federal government. The sale of these assets might not be advantageous to this government. Although it is a little late, the goal is to bring all of those inactive assets to life. According to additional sources, the Federal Government will use its landed properties, particularly those that would be considered “dead capital,” as a means of raising money.

READ MORE: Richest Senators in Nigeria (Top 10)

list of assets that will be sold by FG to fund the 2023 N10.7tn budget deficit

Nigeria is currently experiencing an economic crisis, and the federal government is compiling a list of assets that will either be sold or “concessioned” to finance the N10.7 trillion budget deficit in 2023. More than 25 of these ventures will be made into operational assets that, in certain ways, will generate income for the federal government. To cut down on waste, some of them will be sold completely while others will be provided to investors as equity.

Here is the list of Assets that have been compiled by FG as of this writing.

According to the Ministry of Finance, Budget, and National Planning, the government is considering selling or concessioning the:

- Tafawa Balewa Square in Lagos

- National Integrated Power Projects in Olorunsogo, Calabar II, Benin (located at Ihorbor), Omotosho II, and Geregu II plants.

- The hydropower plants across the country, include Oyan, Lower Usuma, Katsina-Ala, and Giri plants.

- The government is also interested in the earnings from the free zones in Calabar and Kano as well as the Abuja Water Board.

- National Film Corporation, National Theatre, Lagos International Trade Fair, and Nigeria’s Aluminium Smelter Company.

- Additionally, the government intends to transfer ownership of the management of some of the basin authority agencies to the private sector.

- To better compete with other privately-managed logistics companies, several government ministries, like the postal service, will be given as concessions or completely sold to the private sector.

The Minister’s Speech

list of assets that will be sold by FG

As part of the measures to raise its revenue profile, the minister noted that a number of federal roads across the nation were being prepared for tolling under a Public-Private partnership. She also stated that concessions at airports would be implemented to increase federal revenue.

Her words, “We have started the process of re-engineering the Ministry of Finance Incorporated, which is an arm of government that has the responsibility of managing government investments. It has been in existence since many years ago, with the same laws, and has gradually become quite inefficient, to be honest.

“So, we have gotten the approval of Mr. President to rejuvenate MOFI. We have done a lot of studies. We’re now at the stage where, in the next month, or six weeks we’ll be able to launch the new MOFI. We are going to open these assets for investments. So, we are issuing different kinds of equity instruments for investment in these assets.

“The government doesn’t have the capacity to recapitalize some of these assets. So, I am talking about investments like the Bank of Industry; the Development Bank of Nigeria, and several agencies of government or companies that government owns. We have set it (MOFI) up as a world-class investment company, with new management and a new board to move from the civil service structure.

‘‘Currently, it has a unit under the Office of the Accountant-General of the Federation to get core professionals that are really focused and specialized in Portfolio Management.

NIGERIA AND THE 2023 BUDGET

list of assets that will be sold by FG

Every year, Nigeria prepares a federal budget in an effort to improve national planning. This budget typically includes all the information that a budget should, taking into account the anticipated expenses and revenue for the country’s upcoming fiscal year.

The budget is often prepared by the president and his cabinet and then delivered it to the legislative, which then dissects it prescript by prescript in one of the more conspicuous and salutary displays of the salutary principles of checks and balances and separation of powers.

In many states, the executive also prepares its own budgets, which nonetheless go through the standard procedures at the state assembly for approval into law. The budget’s formal presentation typically serves as a preliminary to tumultuous discussions regarding its contents, which has been Nigeria’s experience. In what is perceived as sincere but frequently ineffective attempts to maintain democratic accountability in the cycle of national planning in Nigeria, ministries, departments, and agencies are frequently invited to justify their budgets before joint committees of the National Legislature.

The National Assembly was recently presented with the 2023 budget by President Muhammadu Buhari. The National Assembly has since cleared the budget’s second reading, which was set at N20.51 trillion.

READ MORE: The Richest States in Nigeria (Top 10)

The 2023 budget’s Outlook

The following strategic goals of the National Development Plan 2021–2025 are intended to be achieved through the 2023 Budget according to The State House, Abuja, which has been given the title “Budget of Fiscal Sustainability and Transition:

- Facilitate macroeconomic stability, human capital development, and food security

- Boost manufacturing performance

- Improve defense and internal security

- Improve the business environment and transport infrastructure

- Ensure energy sufficiency

- Promote industrialization focusing on Small and Medium Scale Enterprises

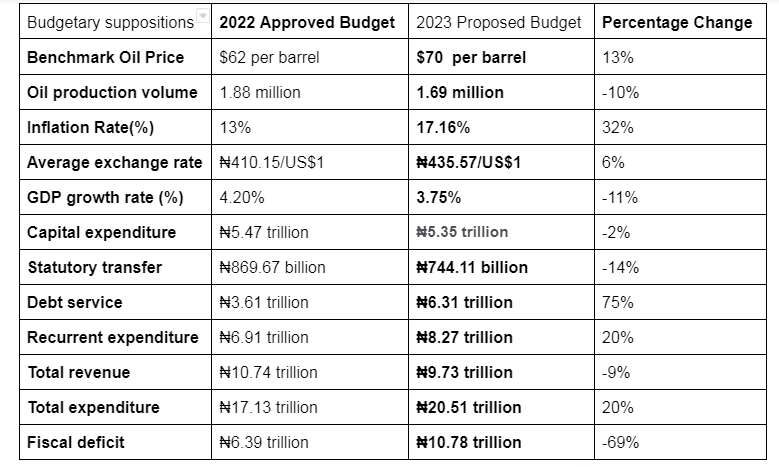

2023 Budget Summary

| Budgetary suppositions | 2022 Approved Budget | 2023 Proposed Budget | Percentage Change |

| Benchmark Oil Price | $62 per barrel | $70 per barrel | 13% |

| Oil production volume | 1.88 million | 1.69 million | -10% |

| Inflation Rate(%) | 13% | 17.16% | 32% |

| Average exchange rate | ₦410.15/US$1 | ₦435.57/US$1 | 6% |

| GDP growth rate (%) | 4.20% | 3.75% | -11% |

| Capital expenditure | ₦5.47 trillion | ₦5.35 trillion | -2% |

| Statutory transfer | ₦869.67 billion | ₦744.11 billion | -14% |

| Debt service | ₦3.61 trillion | ₦6.31 trillion | 75% |

| Recurrent expenditure | ₦6.91 trillion | ₦8.27 trillion | 20% |

| Total revenue | ₦10.74 trillion | ₦9.73 trillion | -9% |

| Total expenditure | ₦17.13 trillion | ₦20.51 trillion | 20% |

| Fiscal deficit | ₦6.39 trillion | ₦10.78 trillion | -69% |