Business News

World Bank’s Projection of a drop in oil prices could cause Nigeria’s economy to suffer more

The current economic crisis in Nigeria is expected to last until 2024 as the World Bank’s Projection of a drop in oil prices…

- World Bank’s Projection of a drop in oil prices could cause Nigeria’s economy to suffer more

- Looming world recession

- The Situation in Nigeria

- Market predictions for oil in 2023

The current economic crisis in Nigeria is expected to last until 2024, with oil prices expected to drop during the following two years.

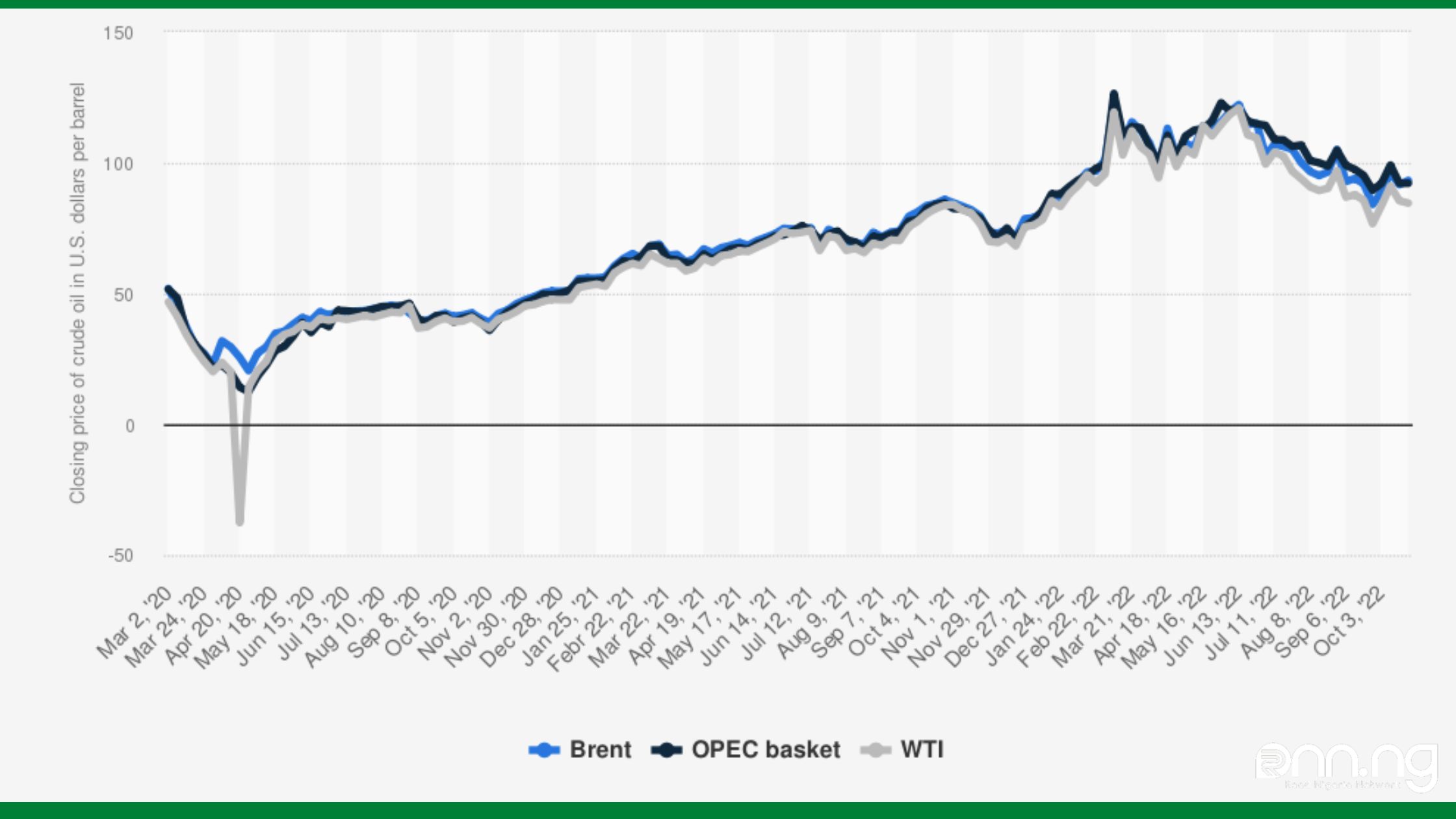

The most recent commodities markets outlook study from the World Bank, which was published on October 26, predicts that oil prices will probably drop from now until 2024. According to the research, Brent crude, the standard oil price, may decline from $120 per barrel in June to $90 per barrel in September. According to the World Bank projection, the price of Brent crude oil may also average $92 per barrel in 2023 and $80 per barrel in 2024.

Looming world recession

Due to continuous policy adjustment, deteriorating financial conditions, and a drop in confidence, global GDP has slowed and is predicted to decrease even more in 2023. The world economy could enter a recession as a result of additional negative shocks like rising prices or financial stress.

Global recessions have historically been linked to sharp drops in oil consumption, albeit the severity has always varied, as observed by the World Bank. The 1980s saw the largest reduction in oil use, with consumption declining for four straight years.

READ MORE: Top 5 Investment Ideas in Nigeria

The Situation in Nigeria

Nigeria has been unable to benefit from the current oil market boom since the beginning of 2022 because of an increase in crude oil theft that has impeded production. Nigeria, therefore, was unable to benefit from high oil prices like other producers of crude oil did. Since crude oil is a substantial component of Nigeria’s GDP today, the theft of crude oil has had a significant negative impact on the country’s economy.

Despite recent advancements in the oil and gas sector in Nigeria (such as a crackdown on illicit oil production and bunkering and the restart of production at the Shell-operated Forcados terminal), Nigeria may not still be able to profit from the world oil market in the following two years. Energy prices are predicted to fall between now and 2024 by the World Bank, which will prevent Nigeria from earning as much money from high oil prices as it could.

Several elements have impacted world oil prices

A multitude of variables is to blame for the steep decrease in oil prices from February to September 2022, according to the World Bank’s October 2022 commodities markets outlook. Among these elements are:

Fall demand

From an average annual growth rate of 3.7% in the first half of the year, the oil consumption rate dropped to 1% in Q3 2022. It is predicted that this growth will become negative in Q4 2022. Oil demand in China fell by roughly 7% in Q3 2022 as a result of mobility restrictions and poorer economic growth (year-on-year). Because of government assistance in the form of reduced gasoline taxes and the usage of fuel subsidies, the demand for oil has been more resilient in other places.

The Russia – Ukraine war

The World Bank projection claims that between February and September 2022, oil prices were incredibly volatile as a result of the Russia-Ukraine conflict. In industrialized economies (other than the United States), the price of Brent crude oil decreased by almost 6%, while it increased by 7% on average and by 3% in emerging poor nations that import oil.

READ MORE: UBA Revenue Increased by 23.3% to N608 billion in the Third Quarter of this Year

Reduction in oil production

According to a projection, world oil production increased by 2% in the second quarter of 2022 (quarter over quarter) and has since returned to its pre-pandemic levels. The Organization of Petroleum Exporting Countries (OPEC) and its partners where production grew by slightly over 2% as production targets were raised and Libya’s output rebounded, accounted for half of the rise. However, the majority of the OPEC+ nations fell short of their output goals. Their collective production fell by almost 3.5 million barrels per day short of their September goal.

Nigeria experienced one of the largest production gaps in September 2022 with a daily production deficit of -0.9 million barrels. Kazakhstan and Russia both saw daily deficits of -0.5 million and -1.3 million barrels, respectively. Since the beginning of the year, operational problems and capacity limitations have caused the difference between targets and actual output to grow.

World Bank’s Projection of a drop in oil prices: The closing price of brent, OPEC basket, and WTI crude oil at the beginning of each week from March 2, to October 24, 2022( in U.S dollars per barrel)

Market predictions for oil in 2023

The World Bank projects that Brent crude oil prices will average $92/bbl in 2023 (very similar to their present level), before falling to $80/bbl in 2024. This prediction is part of its commodity markets outlook (CMO).

The same numbers were forecast by the Bank in its April 2022 CMO. International Energy Agency (IEA) predicts that oil consumption will increase by 1.7% to a new all-time high in 2023 after recovering to its pre-pandemic level by the end of 2022. The gradual easing of epidemic limitations in China and the increased switching from natural gas to oil are both anticipated to encourage an increase in oil consumption in 2023.

However, it is anticipated that outside of Asia, oil demand expansion will be insignificant or even slightly negative in 2023. Less than 1% growth in oil production is anticipated in 2023. Only a few nations, primarily the United States, are anticipated to experience an increase in output.

Russia is likely to lead a drop in OPEC+ countries’ crude oil production. Numerous nations now produce significantly less than the 2 million barrels per day (mb/d) decrease in output that OPEC+ indicated would last through the end of 2023.

As a result, the actual loss might only be slightly more than half of the reported figure, and numerous nations might not experience a decline in production in 2023.

There is also a chance that trade patterns for crude oil and oil-derived goods could change, which might increase the cost of transportation.