Business News

UBA’s Revenue Increased by 23.3% to N608 billion in the Third Quarter of this Year

As of September 2022, UBA’s Revenue Increased by 23.3% to N608 billion in the Third Quarter of this Year. the Bank’s operating income…

- Q3’22: UBA’s gross earnings up 23.3 % to N608bn

- Nigerian Exchange Limited, (NGX)

- Maintain a very strong Balance Sheet

UBA’s Revenue Increased by 23.3% to N608 billion in the Third Quarter of this Year.

United Bank for Africa (UBA) Plc, the largest bank in AFRICA, has reported incredible performance in its independently audited financial results for the third quarter, Q3, which ended September 30, 2022. Its gross revenues increased significantly by 23.3 percent to N608 billion from N493 billion recorded in the comparable period, September 2021, Q3’21.

As of September 2022, the Bank’s operating income increased by 27.3% to N414.1 billion, up from N334.8 billion realized a year earlier.

READ MORE: Top 10 Best Banks In Nigeria (2022)

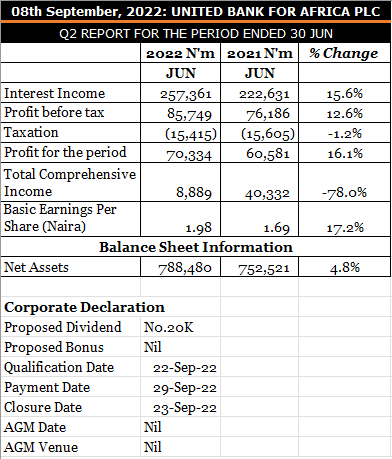

According to UBA’s financial report submitted to the Nigerian Exchange Limited (NGX), profit before tax increased by 12.3% to close at N138.5 billion, up from N123.4 billion at the end of the third quarter of 2021. Profit after tax also increased significantly, by 10.9% to N116 billion, up from N104.6 billion, maintaining its annualized return on average equity for the third quarter of 2022 at 19.2%.

Maintain a very strong Balance Sheet

The bank benefited greatly from its technology-led initiatives over the past few years aimed at improving customer experience, with Customer Deposits rising to N7.03 trillion, representing a 10.4% increase, up from N6.4 trillion at the end of the last financial year. As always, UBA continues to keep a very solid balance sheet, with total assets rising to N9.3 trillion, showing a 9.1% increase over the N8.5 trillion recorded at the end of December 2021.

UBA’s Revenue Increased by 23.3% to N608 billion

UBA’s Group Managing Director/Chief Executive Officer, Mr. Oliver Alawuba, commented on the results, noting that the Group has continued to demonstrate notable operating strength despite major economic challenges in its present markets and a higher global risk environment. He also noted that the bank continues to have an advantage over its competitors in the sector due to its strong portfolio management model and steadfast focus on customer satisfaction.

In order to support the goal of delivering greater value to our stakeholders, he stated, “We continue to reap the benefits of our diversification strategy and customer-first mindset and create resilience in our operations across Africa and the rest of the world.

“This has resulted in significant financial advantages, which are shown in the rise in both our customer deposits and net interest margin. Alaba added, “With the significant growth of our payments and transaction banking solutions, we are strategically positioned to drive our market share in our operational nations.

Source: vanguardngr.com