Business News

Stock investors lose N1.7tn in one week

Stock investors lose N1.7tn in one week following sharp declines in the stock prices of Airtel Africa Plc, Beta Glass Plc, and NEM…

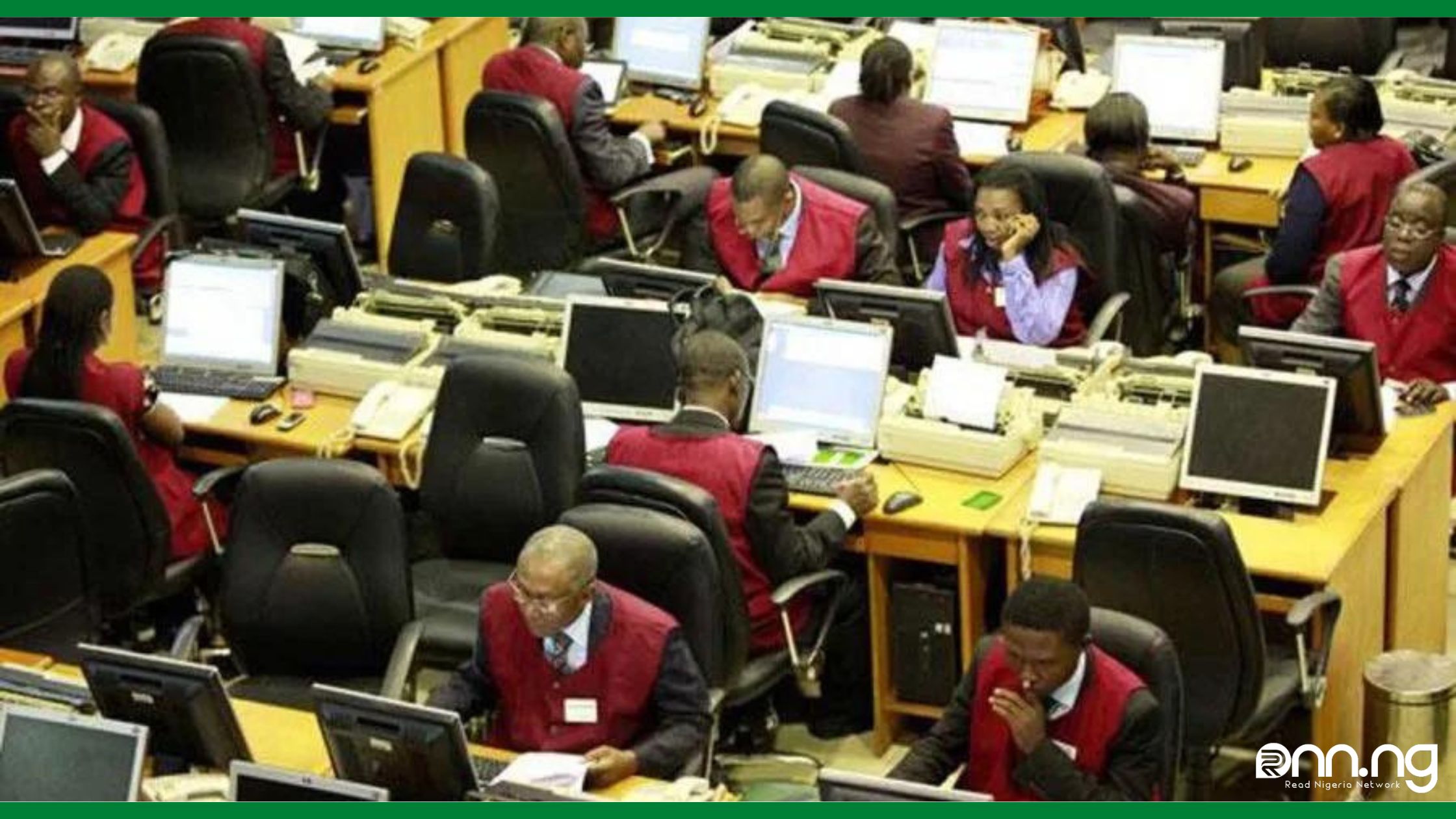

Stock investors lose N1.7tn in one week: Following sharp declines in the stock prices of Airtel Africa Plc, Beta Glass Plc, and NEM Insurance Plc last week, investors lost N1.7tn at the close of trading on the floor of the Nigerian Exchange Limited.

On October 14, 2022, the market entered the trading week with N25.91 trillion and closed at 24.182 trillion on October 21, 2022. The loss of N2.3 trillion by Airtel Africa, Beta Glass, and NEM Insurance collectively at the close of the trading week to lead the losers’ list was a key contributor to the depreciation.

Stock week’s performance

With a loss of 27.10%, Airtel Africa Plc, which had been trading at N1,800 per share, was at the top of the losers’ list. The share price of Beta Glass Plc decreased 9.98% from the trading week’s opening price of N46.10 to close at N41.50 per share.

Read more: Stocks to Buy as Insurance Against Nigeria’s Surging Inflation

The local stock exchange ended with a loss, down 667 basis points, or 6.7%, for the week.

With value exchanged at N4.4m and volume traded totaling 6.6 million units, the Insurance index was the highest loser for the week under review, falling by 370bps. Similar declines were seen in the Oil and Gas index, which lost 150 basis points, and the Consumer Goods index, which lost 90 basis points, with volume and value traded closing at 3.3 million units and N67.9 million, respectively.

The Industrial Goods and Banking indices, on the other hand, had gains of 320 bps and 120 bps, respectively. At the end of the trading week, the two indexes’ volume traded finished at 1.6 million units and 65.0 million units, respectively, while their value traded closed at N50 million and N1.7 billion.

Treaded result

Investors traded a total of 938.020 million shares worth N16.701 billion in 15,700 trades this week as opposed to 491.815 million shares worth N11.922 billion that changed hands in 14,350 deals the previous week.

Volume-wise, the Financial Services Industry topped the activity chart with 501.278 million shares worth N5.080 billion exchanged in 8,279 deals, or 53.44 percent and 30.42 percent, respectively, of the total stock turnover volume. The Oil and Gas Industry came in second with a turnover of 28.244 million shares worth N983.561m in 846 trades, and the ICT Industry came in third with 316.347 million shares valued at N8.729bn in 1,249 deals.

In response to the week’s performance, Mr. Tajudeen Olayinka, a capital market analyst, said the market would experience a protracted repurchase of equities across the board and that a rebound would happen until the economy stabilized.

Source: punchng.