Top Lists

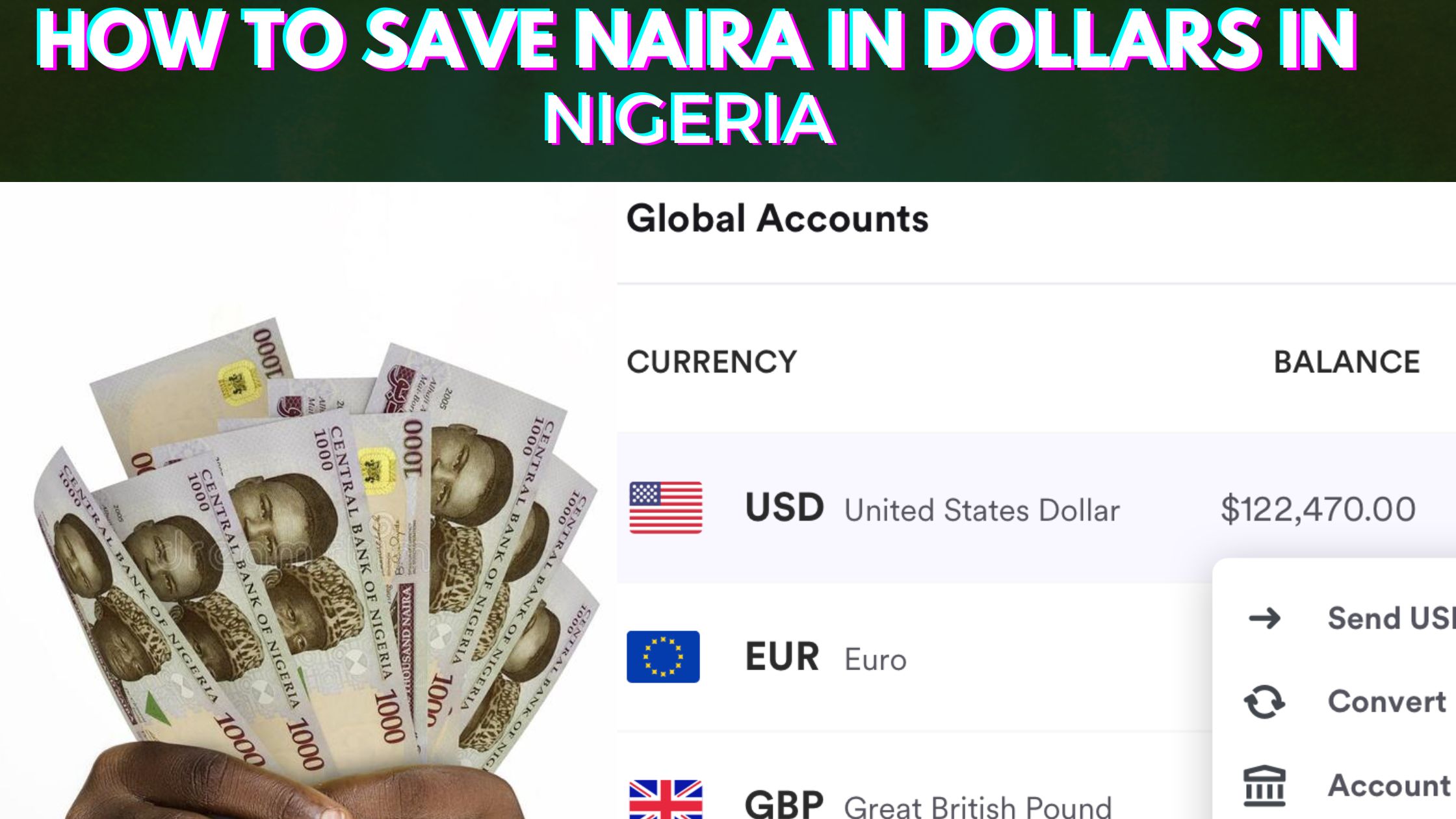

How To Save In Dollars In Nigeria in 2022 (Top 8)

Many Nigerians are looking for better ways to save in dollars because the value of the Nigeria currency (naira) is rapidly declining

How to save in dollars: would anyone want to save in naira despite its sharp decline in value in recent years? The basic answer is that we save money in order to cover unplanned or emergency expenses. Additionally, having savings gives you financial security. In other words, you have the courage to take chances, and risks, attempt something new, and deal with uncertainties. But, the big question will be; how to save in dollars?

Savings, nevertheless, might be detrimental if they are impacted by currency devaluation. Sadly, that is still true of the naira, the currency of Nigeria. Naira’s value is rapidly declining. Everyone is therefore searching for a better savings chance that would safeguard their financial situation. But what other form of monetary security is superior to the US dollar?

How to save in dollars

The US dollar, which is also the most traded currency in the foreign exchange market, continues to be one of the strongest currencies in the entire world. It’s unfortunate that Naira experiences the complete opposite.

Although there isn’t much you can do about it, choosing to conserve money is regarded as acceptable.

We go into detail about the advantages of saving in dollars, how to save in dollars in Nigeria, and the top dollar-saving method, and apps in this article. So let’s get started!

READ ALSO: Top 10 Apps to Change Naira to Dollar in Nigeria

Reasons to save in dollars in Nigerians

How to save in dollars: Sincere to say, as individuals and corporations, you should save your Nigerian Naira in US Dollars (USD) for reasons other than the constant Naira devaluation. According to predictions, Nigeria’s economy’s lack of productivity and the necessity for further borrowing could push the Naira to continue to depreciate.

In this situation, how do you plan to preserve or increase the worth of your money? This is the reason why you must carefully read this article and follow cautiously the techniques on how to save in dollars in Nigeria

Numerous financial journalists and reputable economic teams have consistently issued warnings about excessive reliance of the country’s income on crude oil. The majority of firms in Nigeria have to import whatever goods they wish to trade because the country produces and manufactures very little if not nothing. And they frequently pay in foreign currencies at higher costs, with the US Dollar serving as the best currency to trade.

However, it has become an unavoidable reality that a number of other factors play a role in the country’s Naira’s growth and swift decline.

Currency Devaluation

Certain causes underlying the ongoing devaluation of the Naira and other currencies throughout the world are shown by research into national economic histories, the consequences of export strengths, and central banking regimes. So many other reasons contribute to this and it’s part of the reasons why you need to know how to save in dollars in Nigeria

Talking currency devaluation which is a deliberate act of monetary policy by the country’s Apex Bank (highest monetary Authority); this is typically done to promote export promotion strategies and when the value of a nation’s goods and services declines.

How to save in dollars: It has become increasingly obvious that Nigeria’s excessive reliance on oil costs the country more than that, and as a result, the value of the Naira has fallen in accordance with these decreases.

For instant, the entire value of imports into Nigeria is greater than the benefits of our exports to other countries as a nation. These cover all facets of shipping for both goods and services.

Experts have cautioned that these shortcomings must be addressed or the value of the Naira relative to the USD will continue to decline with no chance of recovery absent a concerted national strategy.

How To Save In Dollars

The nation’s economy makes it impossible to deny the truth; this article will walk you through how you can Save in dollars in Nigeria and techniques you may use to convert any portion of your money (Naira) into dollars.

The value of the Naira has continued to decline due to the country’s poor performance on the global market, and the ongoing inflation rate, and it may do so for some time, indicating that it is a bad idea to save all of your money on the local currency (Naira). firstly, please be aware that this content is in no way intended to be financial advice. Also be aware that, under this circumstance, saving in the world’s strongest and most widely accepted currency is the only method to maintain the worth of your money. And the money-saving tips offered in this article on how to save in dollars in Nigeria are drawn from trusted platforms including mobile apps, banking apps, and other platforms.

READ ALSO: Top 10 FinTech Companies In Nigeria (2022)

There are just a few options on how to save naira in dollars in Nigeria. they are:

- Domiciliary Accounts

- Piggyvest Flex Dollar Account

- Cowrywise

- Bundle Africa Vault

- Muna

- Barter

- Crowdyvest

- stablecoins

1. Domiciliary Accounts

Only your bank in Nigeria is authorized to open the sort of foreign currency account known as a domiciliary account for you. With a domiciliary account, you can receive and transfer funds in international currencies like US dollars. Depending on your objectives and preferred bank, you are free to open this account in any currency. Using some of the methods described below on How To Save In Dollars in Nigeria, you can also convert your Naira into a certain foreign currency, let’s say GBP when managing a domestic account. Furthermore, your savings are available for withdrawal in the bank in the currency you choose to save in. Depending on the bank, the steps to open a domiciliary account in Nigeria to be able to save naira in dollars are as follows:

How To Open A Domiciliary Account In Nigeria

- Enter any bank branch of your choice.

- Request for a domiciliary account in dollars. You’ll be given a form to fill out.

- Get any of the following means of identification. Like Voters cards, Driver’s licenses, International Passport, and NIN Card/Slip.

- Passport photos

- Valid Address document (Utility bill)

- Filled out the forms and submit them.

Do well to contact your bank for final guidance on the use and extent of a domiciliary account if you’d want more explanation and guides on how to save naira in dollars.

2. How to save in dollars-Piggyvest Flex Dollar Account

Currently, one of the top saving apps for ways to save dollars in Nigeria in the nation is Piggyvest. Your money is protected because this fintech app is listed in the Nigerian Deposit Insurance Commission’s (NDIC) green file, according to this information. Users of Piggyvest can save naira in dollars via the company’s dollar platform; in this situation, Naira is saved in dollars. Before you can convert your naira savings to dollars on Piggy Flex, you must first deposit naira to your piggy naira account. The amount deposited will be saved after being changed to the dollar’s current exchange rate to naira. The value of your funds also rises along with Naira’s ongoing devaluation. Additionally, Piggyvest offers a yearly interest return of up to 7% on your naira to dollar savings.

How to open a piggyvest flex dollar account

To get started, depending on the device you are using, download the application, and then follow the instructions to register, fund your wallet with naira, and transfer funds to the dollar platform.

3. How to save in dollars-Cowrywise

This savings mobile application is comparable to a piggyvest. You can save naira in dollars, you may plan, and invest your money in dollars using Cowrywise. You can use the app to maintain your financial security, invest, and increase your savings. Also, note that the interest rate changes periodically.

4. Bundle Africa Vault

Another way to save in dollars in Nigeria is through Bundle African. Nigerians can purchase, sell, and convert cryptocurrencies including Bitcoin, Ether, BUSD, BNB, Chainlink, and TRON through Bundle Africa or Bundle. Additionally, you can transfer and receive cash in Nigeria and save dollars there. utilizing a debit card, bank transfer, or digital currency.

You can store money in dollars or, in this example, BUSD, thanks to the Bundle Vault option. This stablecoin is governed by US law and is backed by UD Dollar. The crypto ecosystem uses BUSD as a quicker method of funding deals. You can save BUSD (1 BUSD = $1.00 USD) in the bundle vault and earn up to 5.7 percent interest. You can make withdrawals at any time and save as frequently as you like. Lock your BUSD for 7 days to gain bigger returns or interest. You can deposit money into your bank account via the bundle app.

5. How to save in dollars-Muna

The Muna app is a cryptocurrency wallet that enables you to save funds in a variety of stablecoins, including Waves, USDN, and Bitcoin. A stablecoin linked to the US dollar is the USDN. Muna uses USDN to enable USD saving for their consumers. Additionally, using the Muna app to save will earn you a 15% yearly interest rate. The best thing is that until you withdraw your money, you will continue to collect interest rewards.

6. Barter

Although creating a budget is an essential component of personal finance, keeping track of your daily costs is the key to saving money. The majority of people who are financially successful are aware of every expenditure, so they can consciously choose to conserve money. On the Barter mobile app, you can, however, save in dollars in Nigeria through their dollar account. You can still withdraw money and make payments for nothing online if you successfully register for the free Barter Virtual Dollar Card. Additionally, funds are transferred to other Barter accounts instantly and without any additional fees, freeing up your time and finances for other important tasks. Additionally, barter enables free international transfers.

7. How to save in dollars-Crowdyvest

It’s also among the top applications in Nigeria for money management. For those committed to financial freedom in line with the 17 SDGs, Crowdyvest develops financial solutions.

What crowdyvest is made up with?

- Flex Savings: This lets you deposit money and retrieve it whenever you want.

- Flex Dollar: lets you choose your own terms for saving money.

- Money can be locked in a vault for a set period of time while earning interest.

- Set and achieve savings goals.

8. stablecoins

If you want to invest or save naira in dollars in Nigeria, stablecoins are a fantastic choice. USDT, USDC, and BUSD are three excellent stablecoins.

Stablecoins can be used to start making dollar-denominated savings by using P2P cryptocurrency exchanges like Paxful and Binance in Nigeria.

READ ALSO: Best Credit Cards in the World 2022

Summary

There are ways to save dollars for Nigerians. they are:

- Domiciliary Accounts

- Piggyvest Flex Dollar Account

- Cowrywise

- Bundle Africa Vault

- Muna

- Barter

- Crowdyvest

- Stablecoins