Guides

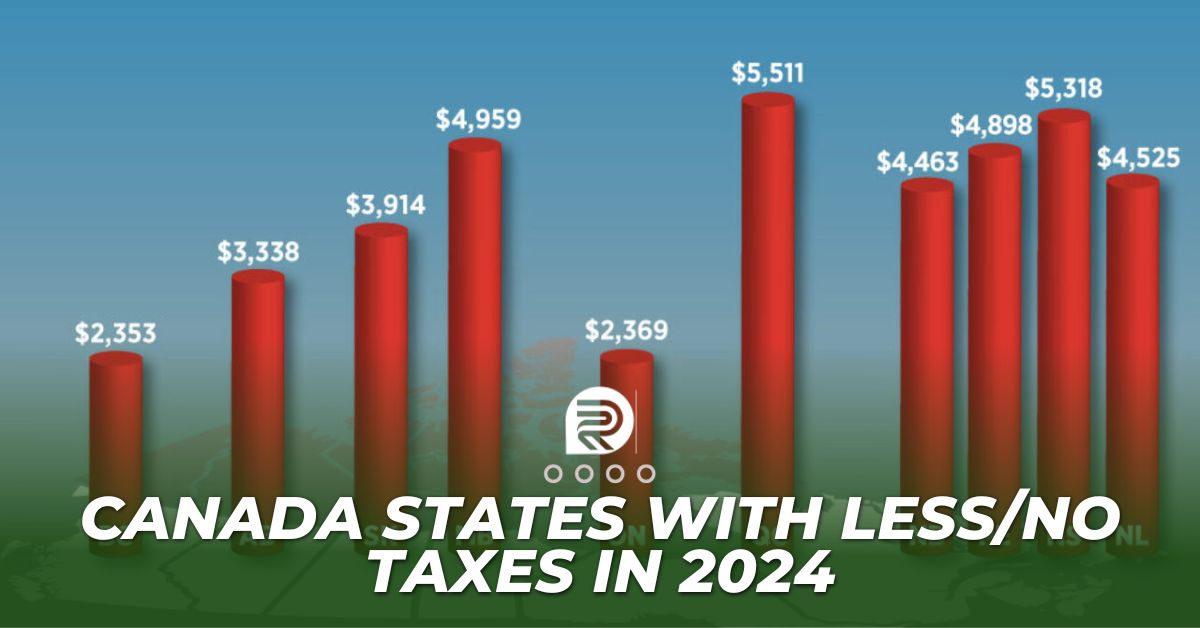

Canada States With Less/No Taxes In 2024

Canada is the home of ice hockey, maple syrup, and abundant natural beauty, and it provides its citizens with a good standard of living. The intricate tax system in Canada contributes to the country’s experience by financing necessary services including infrastructure, healthcare, and education. A potential resident or immigrant needs to understand the tax system and choose which province has the lowest taxes. This article highlights the Canadian states with the lowest tax rates in 2024.

Canada is the home of ice hockey, maple syrup, and abundant natural beauty, and it provides its citizens with a good standard of living. The intricate tax system in Canada contributes to the country’s experience by financing necessary services including infrastructure, healthcare, and education. A potential resident or immigrant needs to understand the tax system and choose which province has the lowest taxes. This article highlights the Canadian states with the lowest tax rates in 2024.

The provinces are the names given to the various parts of Canada. The word “province” was used to refer to several British colonies in Canada before the confederation. The provincial level of government in each Canadian province and territory determines the rate of the Provincial Sales Tax (PST), which is levied in addition to the Goods and Services Tax (GST), which is legislated by the federal government. This makes living in certain locations more affordable than in others.

Provincial Taxes in Canada

There are three types of taxes in Canada: federal, provincial, and local. Whereas local and provincial taxes differ by area, federal taxes are the same nationwide. Provincial taxes include income tax, sales tax, and property tax.

In Canada, income tax is imposed progressively, meaning that rates climb in tandem with income. In most cases, income tax is the result of combining local and federal taxes. The rates and brackets for income taxes vary per province.

In Canada, provincial sales taxes and the federal Goods and Services Tax (GST) are combined to create sales tax. A Harmonized Sales Tax (HST), which blends federal and provincial sales taxes into one rate, is implemented in several provinces. Others have both the GST and a separate Provincial Sales Tax (PST).

Provinces and municipalities have different rates for property taxes, and the total amount of taxes paid depends on the location and value of the property.

Canada States With Less/No Taxes

Are you relocating to Canada? Do you want to know which regions have the lowest tax rates? Taxes are a major factor for those in Canada who make a living. Given that Canada has a well-developed welfare state and publicly accessible services, taxes are essential to Canadian society and, by extension, to the well-being of its citizens.

It is evident from a comparison of the tax rates in the various Canadian provinces that Alberta has the lowest total tax burden. Here are the Canadian states with the lowest tax rates;

1. Alberta

As one of the jurisdictions in Canada with the lowest tax rates, Alberta comes in first place. It is tied for first place with the three territories of the nation, but it is considerably more populous and has a high average personal income. Alberta is home to more than 4.4 million people, of which 1.6 million are concentrated in Calgary, the biggest city in the province.

Because Alberta has the highest basic personal amounts in Canada, Albertans pay reduced taxes. To put this in perspective, the federal basic personal allowance is $14,398 and Alberta’s is $19,369 Accordingly, those living in Alberta are only subject to income taxes if they earn more than $19,369 annually. In addition, Alberta has the fourth-highest family income and the third-highest average individual income in Canada.

2. Yukon

Yukon is also one of the Canadian states with the lowest tax rates. The Yukon, like the other Canadian provinces and territories, has a very small population, estimated at 43,744 people, but it also has the fourth-highest individual income among them in 2024.

Before taxes, the average individual income is $61,812. This makes Yukon one of the Canadian states with low tax rates. In Yukon, the marginal income tax rate ranges from 21.40% to 48%, while the income tax rate ranges from 6.4% to 15%.

3. Nunavut

With an expected 39,589 residents, Nunavut has the lowest population of any Canadian province or territory in 2024, but it also has the highest individual income. Nunavut is not just the least inhabited area in Canada, but it’s among the least populated worldwide.

Before taxes, the average individual income was $87,355.

In Nunavut, the marginal income tax rate ranges from 19% to 44.50%, while the income tax rate ranges from 4% to 11.50%.

4. Northwest Territories

The Northwest Territories, like the other Canadian provinces and territories, have a fairly tiny population—an estimated 45,605—but they also have the second-highest individual income in 2024

Before taxes, the average individual income is $77,670.

The Northwest Territories have marginal income tax rates ranging from 20.09% to 47.05% and income tax rates ranging from 5.9% to 14.05%.

5. Saskatchewan

Except for the territories, Saskatchewan is one of the Canadian states with the lowest tax rate, after Alberta. With 1,194,803 residents, Saskatoon is the most populated city in Saskatchewan, housing 337,000 of the total population. In Canada, Saskatchewan is ranked sixth for average family income and seventh for average individual income. Between Saskatchewan and Alberta, there is a noticeable disparity in terms of average income and population.

Before taxes, the average individual income is $54,371. After taxes, the average household income is $78,000.

In Saskatchewan, the marginal income tax rate ranges from 25.5% to 47.5%, while the income tax rate is between 10.5% and 14.5%. It’s important to note that, while having comparable marginal tax rates, certain Canadian incomes have quite different income tax experiences due to the differences in Saskatchewan and Alberta’s tax bands

6. Ontario

The most populated area in all of Canada is Ontario, which is found in the east-central region (2). HST and GST are levied at the same rate for Ontario residents, or 13% (1).

8% HST plus 5% GST is a 13% total tax rate.

7. Quebec

The sole French-speaking province in Canada, Québec, has the second-highest population (2). The only province with a provincial tax of its own is Québec, which levies a sales tax at a rate of 14.975% (1).

9.975% PST/QST plus 5% GST is a total tax rate of 14.975%.

More Articles on RNN

Top 10 Richest Musicians in Canada [2024]

7 Tips On How To Travel To Canada Without Stress In 2024